Kevin P. Martin, Jr. is the Managing Director of Kevin P. Martin & Associates, P.C. (KPM), a CPA and business consulting firm with local offices in Boston, Braintree, and Danvers, including CIC. Kevin works with all types of startup companies and has spent his entire career working with companies to monetize Federal and state tax credit programs. Got a question? Kevin can be reached at kmartinjr@kpm-us.com. You can also follow Kevin on Twitter @KPMCPA.

You’ve been working through your great idea for quite some time. You’ve gotten a few bucks from family, friends, and others that believe in you… Maybe even a first round. You’ve set up some awesome digs at CIC. With that, you’ve worked through—and worked through again—the burn for the next year. It’s tighter than you thought… But you—all of you—are determined to make this work… And every dollar matters.

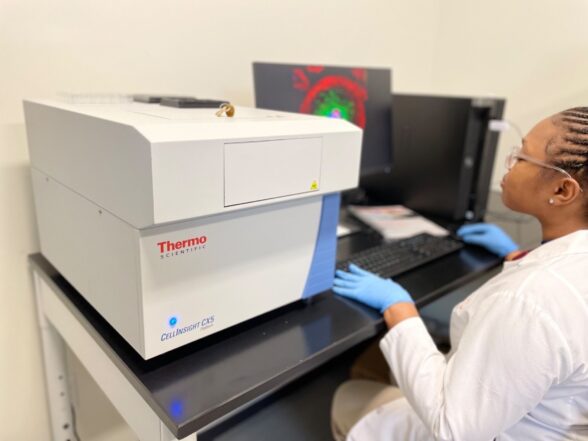

Whether your company is focused around food tech, mobile devices, gaming, robotics, life sciences, or anything in and around, there’s a very good chance that your company is eligible for the research and development (R&D) tax credit.

Beginning with the 2016 tax year, eligible small businesses and their owners can claim the R&D credit against their alternative minimum tax liability. Eligible small businesses include partnerships, sole proprietorships, and privately held corporations whose average, annual receipts for the 3-year tax-period preceding the tax year claiming the credit do not exceed $50 million.

The Section 41 R&D credit was made “permanent” as part of the Protecting Americans from Tax Hikes (PATH) Act of 2015. Permanency creates certainty and confidence and promotes investment knowing that real, offset savings exist. If you are running a startup with gross receipts of less than $5 million, you can apply up to $250,000 of the R&D credit against the company’s “payroll tax liability” beginning in 2017. This creates present value cash flow dollars—a very real way to grow your business.

Before the law changed, the R&D credit was only available to offset “income tax liability”—“income” being something that many startups didn’t have! Practically speaking, the change was made to help early-stage companies maximize current cash flow and promote current research, investment, and innovation.

Even if you are unable to use the R&D credit on a current basis, it’s an asset of the company and the proper accounting treatment is important. The benefit adds to the valuation.

Whether or not the R&D credit is used currently or available for future use, good documentation is important. As you are learning, good documentation is an accounting best practice. Companies have to be prepared to defend the credit to the IRS and make sure the credit is being accounted for in the proper period.

Maybe you never thought of your company as an R&D enterprise. If you are located at CIC, there’s a pretty good chance that it is. The IRS’ definition of R&D is very broad and the rules can be applied to every industry, even if that industry is still being defined. Sure, like everything, it’s a bit more complicated. For example, it’s important to understand exactly what types of activities qualify. A few good examples are wages, supplies, contract research, and leasing costs.

The $250,000 benefit is an annual benefit so businesses can potentially claim the credit for up to 5 years with a maximum of $1.25 million in total credits claimed on their quarterly tax returns.

With all of the things that startups don’t quite get right, let’s not leave this one on the table. The R&D credit creates immediate return-on-investment—maybe for those initial family and friends that helped to get you going!