Organizations have long been faced with a choice: incorporate as a for-profit business or seek non-profit status.

While legal classification in itself doesn’t prevent LLCs, S Corps, or sole proprietorships from prioritizing their values, the for-profit versus non-profit split has often been framed as a tradeoff between money and mission, and there have hardly been options in the middle.

So what’s the right choice for a company that wants to prioritize social responsibility and needs a for-profit structure?

the trade-offs of traditional incorporation

Going the non-profit route, such as in a 501(c)3 capacity, provides tax-exempt status in return for putting all profits directly toward a specific cause. However, this structure often means dependence on donors and the risk of failing to bring in enough cash to stay afloat.

The potential for executive, founder, and shareholder profits are also much more limited (though plenty of charitable group leaders find themselves well paid). These financial limitations make it harder to draw in substantial investment for growth or top tier talent, both at the C level and throughout the organization.

Sticking to a traditional LLC-type structure, on the other hand, might allow for more economic freedom and growth. But it can also fail to inspire customers or accurately reflect the importance of the work the company does. It can also mean heavy tax burdens and lawsuits from shareholders if they think a decision has been made that negatively impacts their returns.

Entrepreneurs are stuck smack dab in the middle: You’re looking for economic growth through shareholder investment while often tackling major issues for the common good at the same time.

That’s where the benefit corporation and related, but distinct, B Corporation certification come in.

WHAT IS A BENEFIT CORP?

Benefit corporations, or benefit corps for short, are for-profit companies much in the same vein as LLCs.

But whereas LLCs and similar businesses are usually obligated to their shareholders, benefit corps are allowed to work either for the benefit of shareholders or for their cause.

What does this look like in practice?

Benefit corps can, say, reinvest profits in the business rather than pay out dividends. Or they can retain staff during a downturn by dipping into cash reserves rather than going through a round of layoffs.

Benefit corps also provide protection for their directors, who aren’t monetarily liable if they make decisions unfavored by shareholders.

To attain and retain benefit corp status, companies must regularly submit benefit reports outlining the social advantages they provide. Reports can be challenged in court if a company appears not to be meeting its obligations.

These accountability measures increase confidence among impact-driven investors, a potential catalyst for attracting investment in the first place.

BENEFIT CORP VERSUS B CORP

Companies may also seek B Corp certification on top of their benefit corp structure, which holds them to a higher minimum standard.

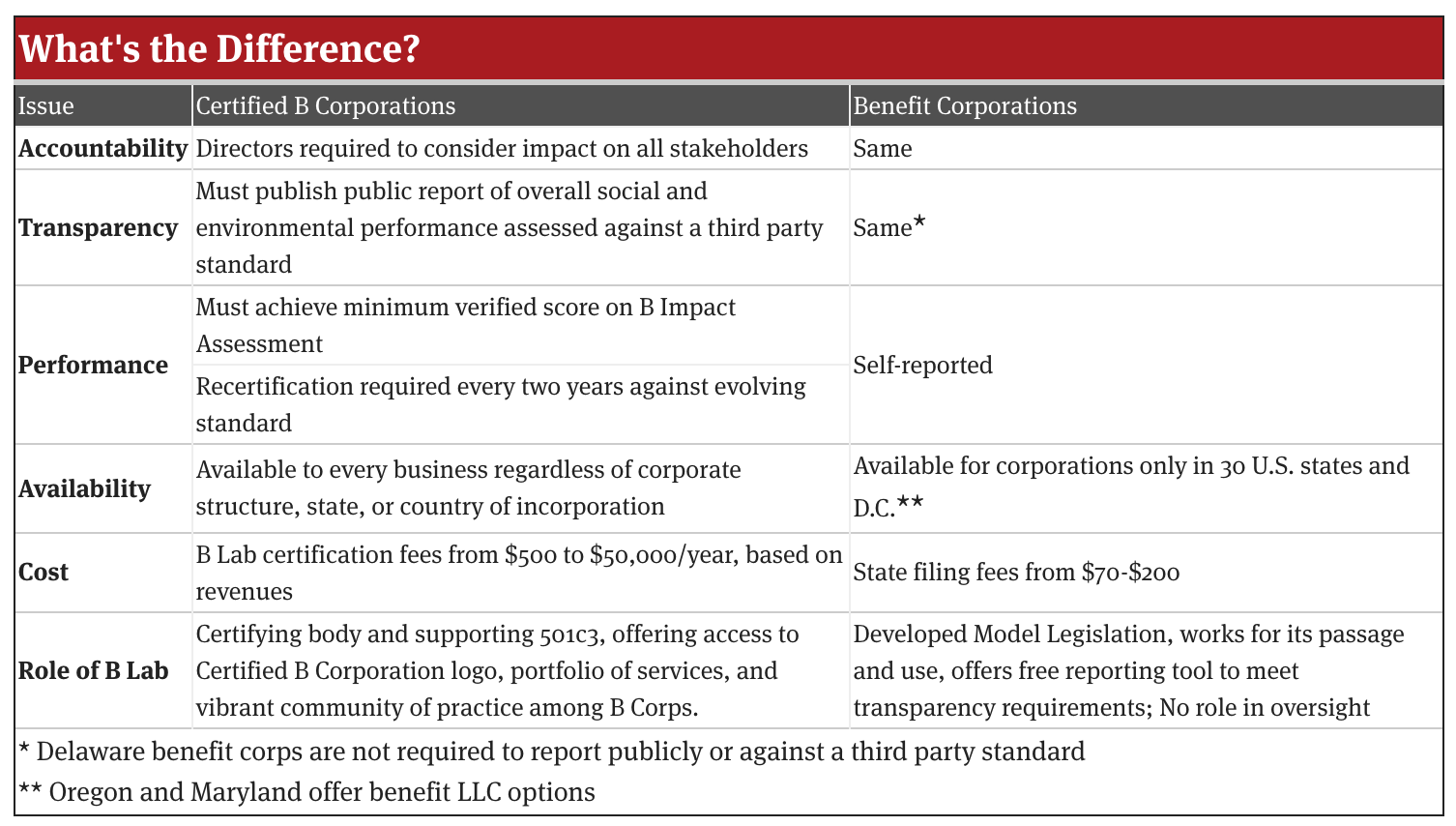

This chart outlines the key differences between the two classifications:

Source: https://www.bcorporation.net/what-are-b-corps/certified-b-corps-and-benefit-corporations

Thirty-four states currently have legislation that allows companies to incorporate as benefit corps, and six more states have laws in the works. B Corp certification, however, is available to organizations across all 50 states and even internationally. Plus, certification is generally open to all businesses regardless of corporate structure.

Certified B Corps pay certification fees every couple years at a rate typically higher than that for benefit corps. If you’re running a young company still working to get off the ground, structuring as a benefit corp might give you the results you want for a lower cost.

VALUE-DRIVEN BUSINESS

Both benefit corp structure and B Corp certification signal a company’s commitment to stated social values, not only to investors and consumers but also to prospective employees.

Wearing your values on your sleeve serves to attract socially conscious people to your company, making it easier to find the right cofounder, CEO, software developer, or HR representative.

So what is the ideal way to structure your modern startup?

Ultimately, the best incorporation is one that matches your company’s mission and most aligns with how you want customers, investors, and partners to view your work.

For many new startups looking to fix the world through innovation, benefits corp structure offers a useful alternative to the traditional LLC or non-profit.